Historic Days for Title Insurance: The State of the Title Insurance Market in 2022

A Short Primer on Title Insurance (and its historic years of 2020-2021)

Pinnacle is proud to serve a number of title insurance providers with actuarial consulting services. Title insurance can sometimes be an underrecognized and occasionally unappreciated market, so Pinnacle keeps a close eye on emerging trends and patterns for our clients.

Our regular Pinnacle APEX Webinar on title insurance contains updates and critical information. Our 2021 APEX deep dive discussed how historic the years 2020 and 2021 were for the title industry. This year, Pinnacle will once again check-in on the market and discuss what’s new and what’s changed.

We’ll share more in an upcoming blog, but we wanted to provide a little background on title insurance, commonly seen but sometimes not carefully understood.

Every home purchase in the United States requires title insurance; it is ubiquitous on home closing checklists.

Although title insurance may be seen by most consumers as just another line item at home closings, this type of insurance offers a great deal of protection in the event of title defects. While most personal consumers of mortgages and real estate transactions know that title insurance exists, perhaps fewer understand what title insurance covers and how the process works.

Title insurance is a unique form of indemnity coverage that protects homebuyers and lenders from losses arising from defects in the title to a property that were undiscovered (or not discernible) prior to the real estate transaction.

Defects can refer to any dispute or unresolved issue in the title – the most common being liens, back taxes or conflicting wills.

Title insurance exists for three purposes:

- to protect the financial interests of the parties in real estate transactions (owners and lenders),

- to assure that property transfers are secure, and

- to facilitate real estate transactions.

One of the key features of title insurance is the title search: the process of establishing the ownership history of a piece of property through public records searches. After a title company prepares a title search report and issues the policy at closing, the buyer pays a one-time lump sum premium payment to cover the costs of fixing defects and any claims that may arise in the future.

Title insurance is required by both buyer and lender to protect their interest in the mortgage loan. It differs from traditional insurance in that the buyer is not typically the one seeking out the insurance company. Instead, the title insurance company is typically assigned by the lender at the time of closing. For this and other reasons, most homeowners are unaware of which title insurance company they have and are even unaware that they had a choice.

Policy Types and Comparison to Property/Casualty Insurance Market

The two main types of title insurance policies are the owner’s policy and the lender’s policy. The owner’s policy protects the buyer in a real estate transaction, covers the amount of the purchase price and remains in effect until the property is sold. The lender’s policy protects the lender, covers the amount of the loan and remains in place until the mortgage is paid off or refinanced.

There is also a distinction between policies written for a new home purchase versus for a refinance. A new home purchase requires both an owner’s and a lender’s policy; however, a refinance only requires a new lender’s policy, as property does not change hands.

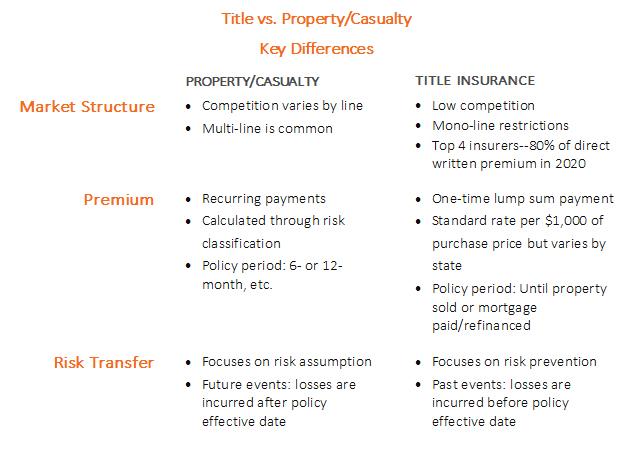

Clearly, title insurance is a very unique product, and it differs from property/casualty insurance in several ways – the first being the method of risk transfer. Title insurance is focused on risk prevention, whereas traditional property/casualty insurance is focused on risk assumption. Title insurance covers past losses incurred before the policy effective date, while property/casualty insurance covers future events incurred while the policy is in-force.

In terms of market structure, title insurance is characterized by mono-line restrictions and low competition. In fact, in 2020, the top four insurers accounted for over 80% of direct written premium. On the other hand, property/casualty insurance is generally characterized by higher competition, and carriers often specialize in multiple lines of business.

With regard to premium, title insurance is purchased through a one-time lump sum payment, whereas property/casualty insurance generally features recurring premium payments. The title premium amount is calculated as a standard rate per $1,000 of the home purchase price, and that rate varies by state. For property/casualty insurance, the premium is determined through individual risk classification. Also, while a title insurance policy is in effect until the property is sold or the mortgage is paid, a property/casualty policy typically expires after six or 12 months.

What is also significant, and unique to title insurance relative to property/casualty, is that criteria such as insurability and other characteristics of the homebuyer are not considered in determining title insurance premium, unlike how premium is determined with homeowners or auto insurance.

It’s important to truly understand these fundamental differences between coverages. Their implications for pricing, reserving and even for investment activities such as mergers and acquisitions are essential to ensure your actuarial provider is providing the very best work product.

And we have so much more! Please don’t forget to join us to hear more about current state of the market on our upcoming Pinnacle APEX Webinar.